when to expect unemployment tax break refund tracker

At this stage unemployment. When can I expect my unemployment refund.

Irs Refund Tracker Why Is Your Tax Return Still Being Processed Marca

When can I expect my unemployment refund.

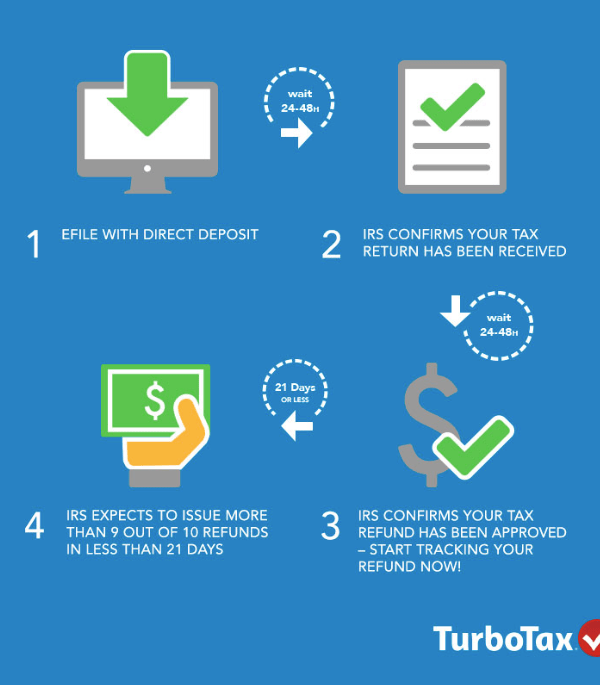

. The IRS will begin in May to send tax refunds in two waves to those who benefited from the 10200 unemployment tax break for claims in 2020. If you claimed unemployment last year but filed your taxes before the new 10200 unemployment tax break was announced the IRS says you can expect an automatic refund. It can be really frustrating but the best advice we give people is patience People arent getting their refunds that theyre used to getting in less than 21 days said Sharpe.

Not the amount of the refund. Its best to track your refund using the wheres my refund tool mentioned above. Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30.

Four million Americans will receive their unemployment tax refunds this week Credit. The amount of the refund will vary per person depending on overall. This is the fourth round of.

One way to know the status of your refund and if one has been issued is to wait for the letter that the IRS sends taxpayers whose returns are corrected. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to those who qualify for the. Sadly you cant track the cash in.

These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset debt. Meanwhile households who are receiving the cash refund by paper check can. These letters are sent out.

When to expect a refund for your 10200 unemployment tax break. The tax break is for those who earned less than 150000 in adjusted gross income and for unemployment insurance received during 2020. Expect the notice within.

Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. The 10200 tax break is the amount of income exclusion for single filers not the amount of the refund. If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records.

The first jobless benefits worth 10200 were defined as non-taxable in March in Bidens American Rescue Plan. The Internal Revenue Service says it will work on refunding money to people who filed their tax return before claiming the new break on unemployment benefits. When can I expect my unemployment refund.

The 10200 tax break is the amount of income exclusion for single filers. The amount of the refund will vary per person depending on overall. This is the fourth round of refunds.

The amount of the refund will vary per person depending on overall. This is the fourth round of refunds. Taxpayers who had filed their tax returns earlier than the.

Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. The 10200 tax break is the amount of income exclusion for single filers not the amount of the refund.

Why Is It Taking So Long To Get My Tax Refund Irs Processing Backlog Updates Aving To Invest

Unemployment Tax Refund 169 Million Dollars Sent This Week

Irs Automatically Sending Refunds To People Who Paid Taxes On Unemployment Benefits The Washington Post

Irs Tax Refund Delays Persist For Months For Some Americans Abc7 San Francisco

When Will Irs Send Unemployment Tax Refunds Weareiowa Com

How To Track Tax Refunds And Irs Stimulus Check Status Money

Irs Issued 430 000 More Unemployment Tax Refunds What To Know Cnet

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Here S How To Track Your Unemployment Tax Refund From The Irs The Us Sun

Unemployment Benefits Tax Refund Will You Receive One Waters Hardy And Co P C

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

For Those On Unemployment Last Year A Possible Tax Surprise Marketplace

Where S My Tax Refund The Turbotax Blog

Tax Refund Status Is Still Being Processed

How To Check The Status Of Your Unemployment Tax Refund R Irs

:max_bytes(150000):strip_icc()/when-to-expect-your-tax-refund-5113992_V2-a610e67e7fc346ed8ab156ddbbc58173.png)