tax benefit rule calculation

This means that in the year the money was listed as a deduction the taxpayer wound up paying less tax as a direct. The tax benefit shown in the summary section is defined by the following equation.

Tax Changes For 2022 Kiplinger

Year 1 interest paid year 1 property tax paid- if marked as deductible year 1 MI paid- if marked.

. Tax benefits include tax credits tax deductions and tax deferrals. Income Tax Calculation 2022 23 How To. A tax benefit is a rule that allows you to pay less in taxes than you would without the benefit.

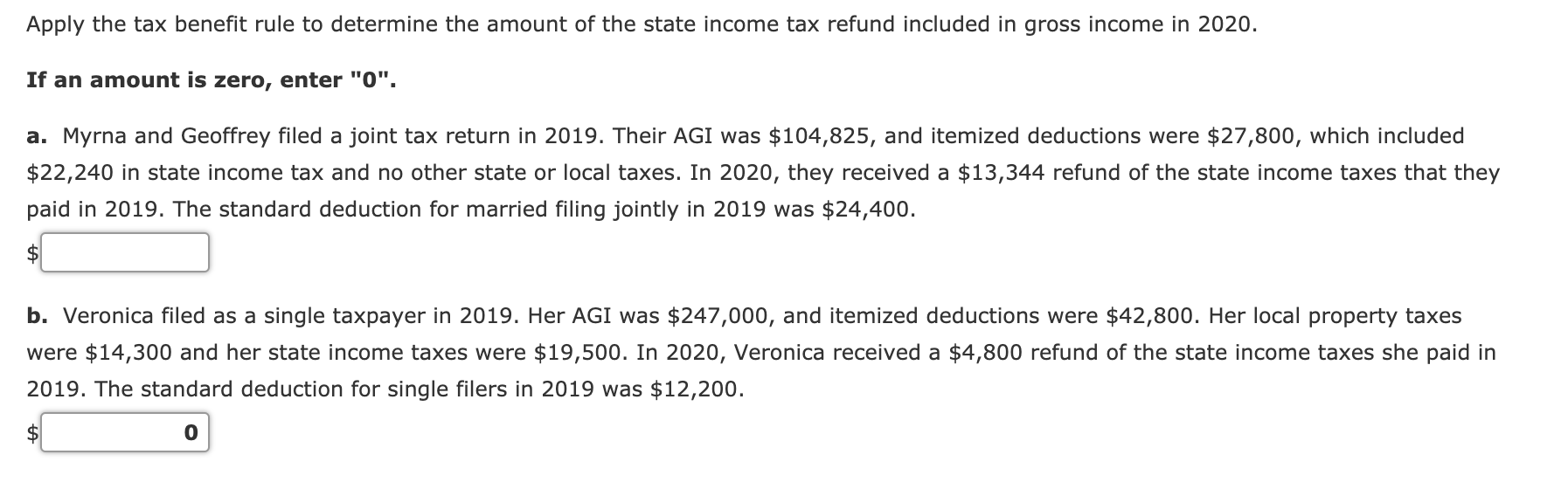

Thus B is not required to include the 750 state income tax refund in Bs gross income in 2019. 12571 to 14732 starter rate of 19. Tax amortisation benefit calculation under.

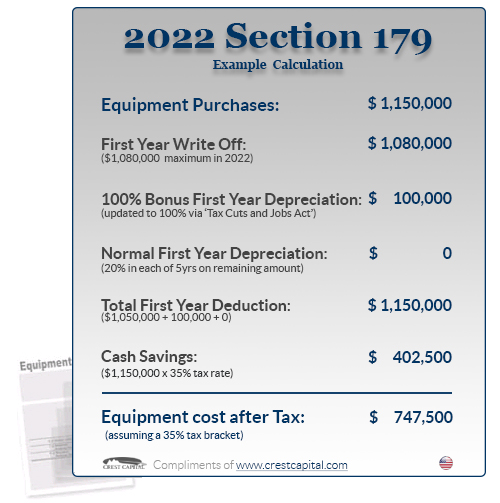

164 generally provides an itemized deduction for certain taxes paid or accrued during the tax year. 164 b 6 as added by the law known as the Tax Cuts. If using the cents-per-mile rule to value the benefit for the employee you multiply the number of miles the employee uses the vehicle for personal use by the IRS.

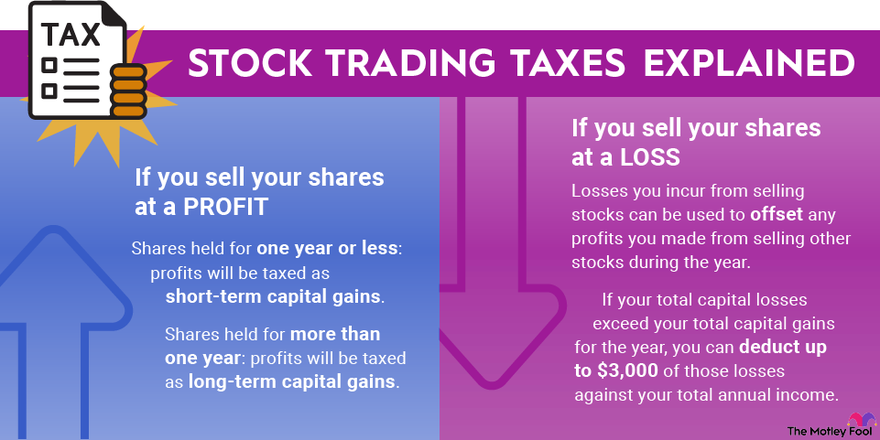

The tax benefit rule only applies if there is a tax benefit. Definition of Tax Benefit Rule If you recover a cost that you had deducted in a previous year you must include it in your income in the year that it is recovered. These are the current income tax rates.

Your tax benefit is the difference between the 12600 deduction you would have claimed without the state tax. No tax paid on 12570 personal allowance. A rule that provides that the amount of an expense recovered must be included in income in the year of the recovery to the extent the original expense.

Dividing this by the marginal tax rate for regular tax purposes 28 results in 646 the approximate amount of income taxes that did not produce a tax benefit. The total tax deduction of 200000 that can be claimed under Sections. 14733 to 25688 Scottish basic rate of 20.

What is the Tax Benefit Rule. Your employee travels 12000 business miles in their car - the approved amount for the year would be 5000 10000 x 45p plus 2000 x 25p. The tax benefit rule states that if a deduction is taken in a prior year and the underlying amount is recovered in a subsequent period then the.

Taxable Income Formula Examples How To Calculate Taxable Income. The TAB is calculated by using a two-step procedure. The benefits you could get.

INR 1000- grows to INR 138949 after 5 years Minimum of Rs. This will give you an estimate of. 100- No Maximum Limit a Who can open - i a single adult ii Joint Account up to 3 adults.

Rates per business mile. You can use an independent free and anonymous benefits calculator to check what you could be entitled to. Received no tax benefit from the overpayment of 750 in state income tax in 2018.

The National Pension System tax benefit under Section 80 CCD1B alone can save 15600 in taxes in a year. Tax amortisation benefit TAB refers to the net present value of income tax savings resulting from the amortisation of intangible assets. 1000- and in multiples of Rs.

Tax benefit rule calculation Wednesday June 1 2022 Edit. When the couple paid the excess refund 400 to the state in the prior year it increased their itemized deduction on their federal return to 14000 from 13600.

Publication 17 2021 Your Federal Income Tax Internal Revenue Service

Selling Stock How Capital Gains Are Taxed The Motley Fool

Solved Apply The Tax Benefit Rule To Determine The Amount Of Chegg Com

Tax Planning For Retirement Ameriprise Financial

Self Employed Health Insurance Deduction Healthinsurance Org

Tax Benefit Rule Refunds Previously Claimed As Itemized Deductions Worksheet

What Is The R D Tax Credit And Could Your Company Qualify

.png)

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Turbotax Tax Tips Videos

How Taxes Can Affect Your Social Security Benefits Vanguard

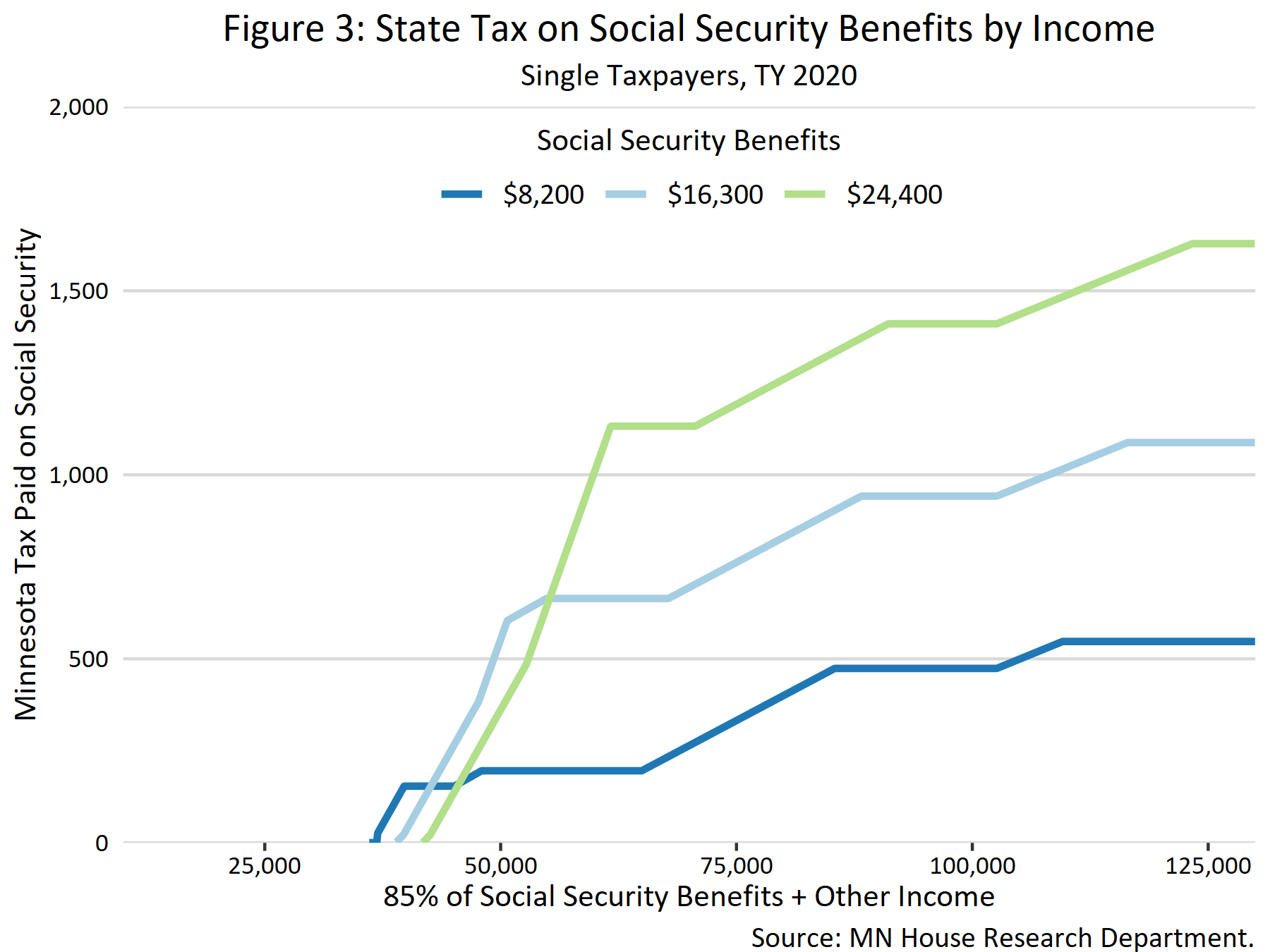

Taxation Of Social Security Benefits Mn House Research

What Is The Standard Deduction Tax Policy Center

How Taxes Can Affect Your Social Security Benefits Vanguard

What Is The Tax Benefit Rule The Benefit Rule Explained

Net Operating Losses Nols Formula And Calculation

:max_bytes(150000):strip_icc()/state-income-tax-deduction-3192840_FINAL_v3-42fac1f5ce444c9a8a317c9a598e8084.png)

The State And Local Income Tax Deduction On Federal Taxes

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

What Is The Pass Through Tax Deduction The Ascent By Motley Fool