do you have to pay taxes on inheritance in tennessee

Most Tennessee homeowners pay around 1200 annually in property taxes. Tennessees property taxes and property tax rates are quite low.

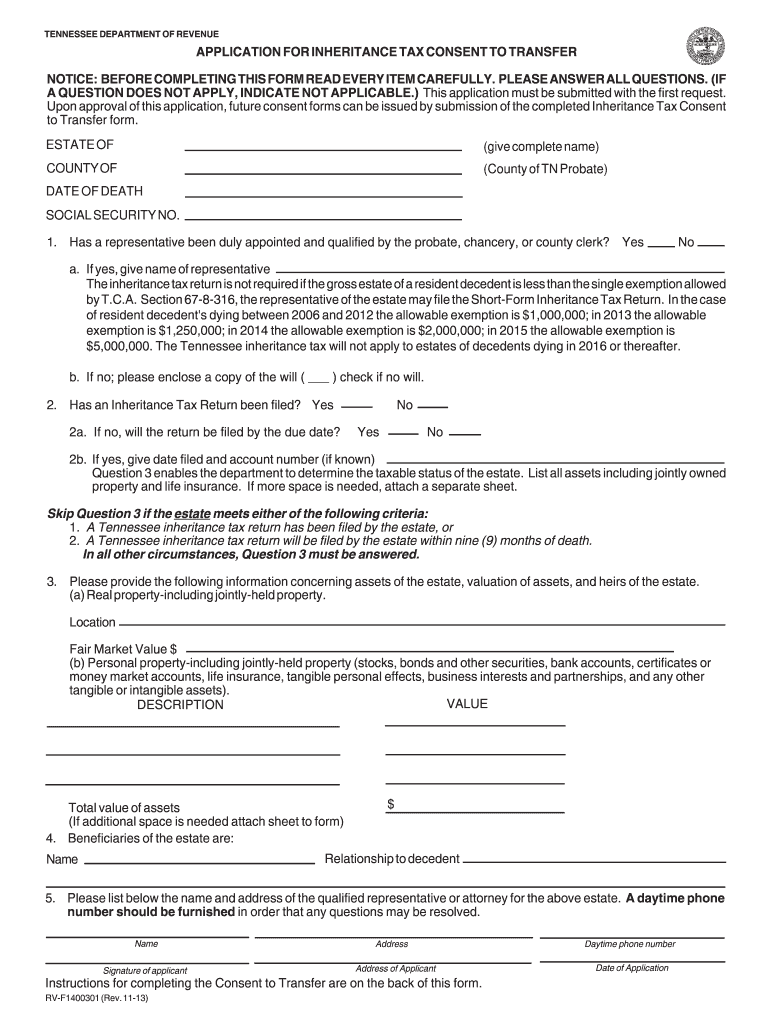

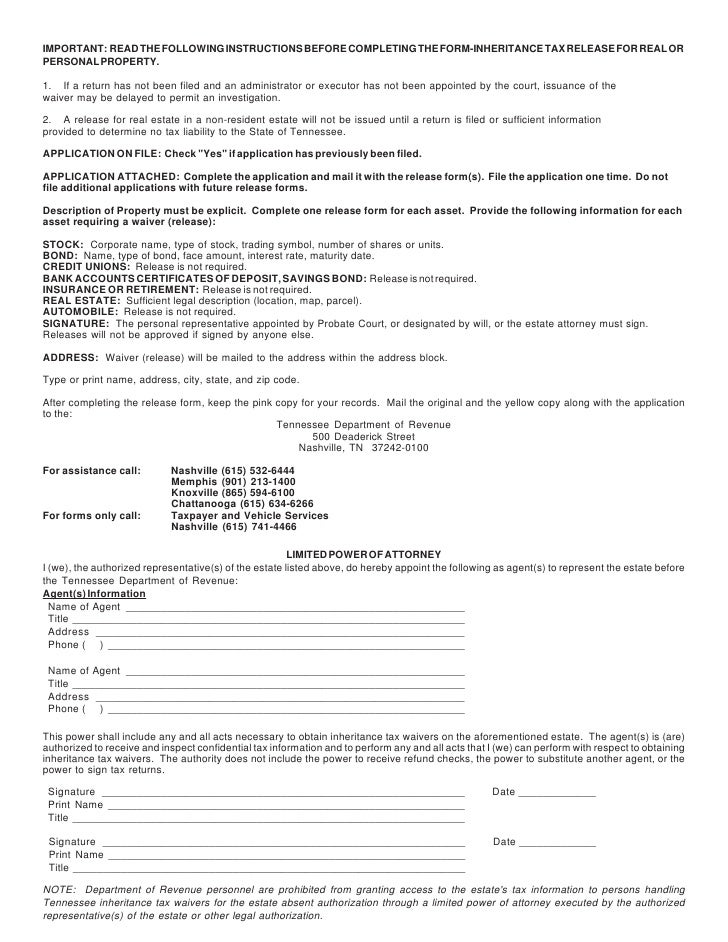

Tn Form Waiver 2013 Fill Out And Sign Printable Pdf Template Signnow

You do see a trade-off when it comes to the major taxes that states levy Loughead says.

. If the individual taxpayer does not use a certified software vendor or if the taxpayer does not have an FEIN the taxpayer may file a paper return. You will have to include the interest income from inherited cash and dividends on inherited stocks or mutual funds in your reported income for. How high are property taxes in Tennessee.

If you ultimately cannot find the trust document youll need to work with a local estate planning attorney to transfer the assets via a court order. Some gifts you give. The average effective property tax rate is 064 15th-lowest in the country.

Quarterly estimated payments 15th day of the fourth sixth and ninth months of the current tax year and the 15th day of the first month of the next succeeding tax year if you have a. 4 Ways to Protect Your Inheritance from Taxes. All entities also may file and pay electronically using the Tennessee Taxpayer Access Point TNTAP.

There are no income taxes whatsoever in Tennessee. If youre a really high-income individual youre probably going to. Annual 15th day of the 4th month following the close of your books and recordsFor business with a 11-1231 calendar year this tax is due on April 15th of the following year.

The estate can pay Inheritance Tax at a reduced rate of 36 on some assets if you leave 10 or more of the net value to charity in your will. If you do find the trust document your next step is to read it. Your minimum distributions will be smaller which means youll pay less tax on them and the money can grow tax deferred for a longer period of.

If you find assets that are held by a trust youll need to locate the trust document to be able to transfer them. You can find a list of approved software vendors here.

Tennessee Inheritance Laws What You Should Know Smartasset

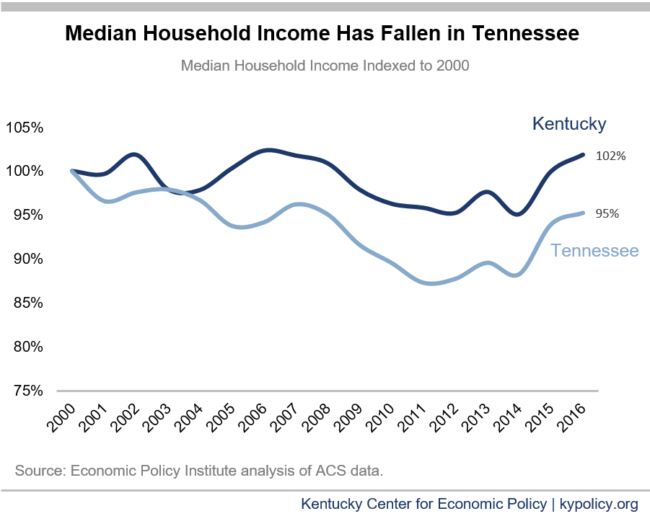

Shifting To A Tennessee Like Tax System Would Harm Kentucky Kentucky Center For Economic Policy

How To Get A Marriage License In Tennessee Zola Expert Wedding Advice

Divorce Laws In Tennessee 2022 Guide Survive Divorce

Tennessee Health Legal And End Of Life Resources Everplans

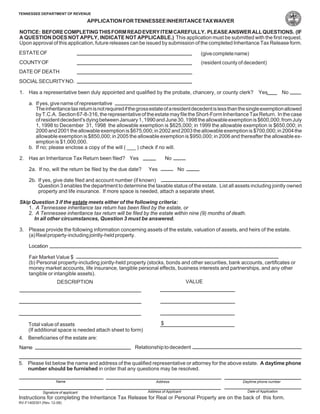

A Guide To Tennessee Inheritance And Estate Taxes

What Is Estate Planning And Why Do It Hermitage Mt Juliet Tn

State By State Guide To Taxes On Retirees Tennessee Gas Tax Inheritance Tax Income Tax

Where S My Tennessee Tn State Tax Refund Taxact Blog

A Guide To Tennessee Inheritance And Estate Taxes

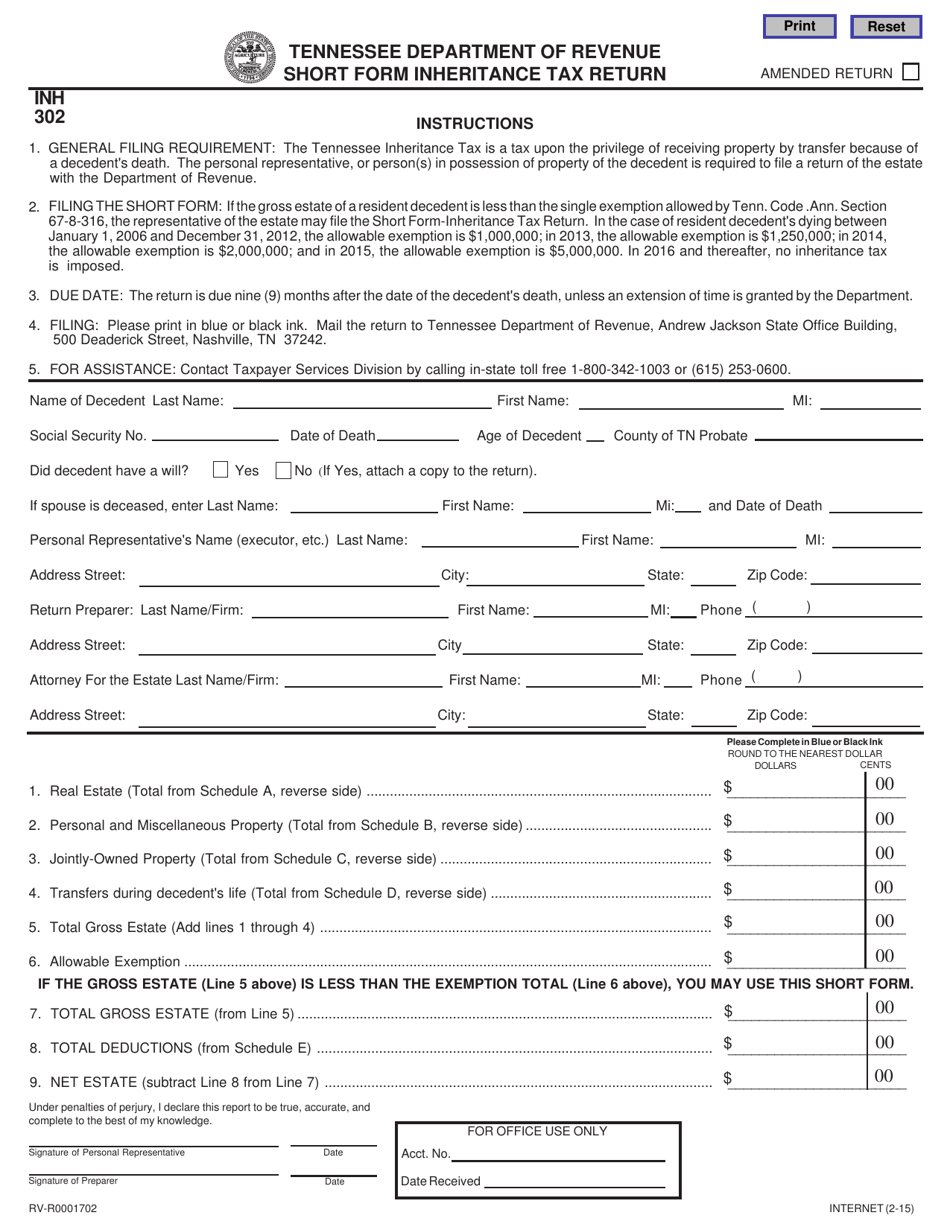

Tn Dor Inh 302 2015 2022 Fill Out Tax Template Online Us Legal Forms

Form Rv R0001702 Inh302 Download Fillable Pdf Or Fill Online State Inheritance Tax Return Short Form Tennessee Templateroller

Tennessee Corporations Partnerships And Associations Law Annotated Lexisnexis Store

States That Won T Tax Your Retirement Distributions Income Tax Income Tax

Pin By Graceful Aging Legal Services On Estate Planning Estate Planning Attorney Legal Services Estate Planning

Wildlife And Boating Safety Laws Of Tennessee Lexisnexis Store

What You Need To Know About Tennessee Will Laws